The UAE Dirham is the currency of the United Arab Emirates.

Below we’ll look at the currency’s history, its coins, banknotes and the economy that sits behind it.

A bit of history…

The United Arab Emirates is located in the eastern part of the Arabian Peninsula. They are a federation of seven independent emirates that each have their own Emir but elect a shared President and Vice-President.

They consist of Abu Dhabi, Ajman, Dubai, Fujairah, Ras Al Khaimah, Sharjah and Umm Al Quwain. Abu Dhabi is the capital and biggest of the emirates.

For a long time, the emirates were under the domination of the British Empire, they were known as the ‘Trucial States’ and for a long time used the Ottoman Lira.

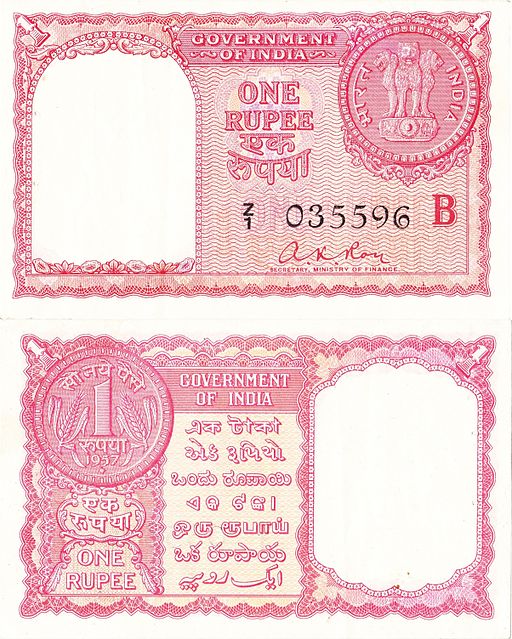

Following WW2, they became a British Protectorate and the country used the Gulf Rupee, a currency that was first strongly connected with Sterling and then with India and their Rupee. Other Gulf nations like Kuwait, Bahrain and Qatar used this currency.

In the 60’s the Gulf Rupee was replaced and the country formed its own currency, the UAE Dirham in 1973.

Coins and Banknotes…

The dirham is divided into 100 fils and is pegged to the US Dollar at a rate of AED three-point-six-five per USD.

Coin designs on the obverse side of the Dirham include a Falcon and the national emblem of the UAE, while the reverse side features traditional Arabic calligraphy. In 2018, a new Dirham coin was introduced with a more modern design.

Dirham notes come in denominations of five, ten, twenty, fifty, one hundred, and 200 Dirhams. The 500 Dirham note was introduced in 2000 but is not frequently used. New design banknotes for the 5, 10 and 50 UAE Dirham were introduced in 2022.

An oil based economy...

The UAE economy has been one that has seen a boom in the last couple of decades. Since the 80s it has seen growth nearly every year.

Like the rest of the world, the country saw a dip in 2020 due to COVID-19 but the country is once again back to growth. Recent figures show a 4% rate of GDP growth.

The economy of the UAE is heavily reliant on oil exports. 80%+ of its revenue comes from this sector. Like many other countries though in the region, the country is looking to diversify. It has been actively trying to grow its tourist industry and position itself as a tech/business hub. There are several special low-tax zones.

At present, the currency value is intrinsically tied to oil prices. As long as they remain high, the currency will remain one of the world’s more stronger currencies.